Спасибо за письмо

As an investor, it’s smart to look at key financial metrics to make well-informed decisions about the companies you add to your portfolio. One important metric is the gross profit margin, which you can calculate by subtracting the cost of goods sold from a company’s revenue. Gross profit percentage is a measure of profitability that calculates how much of every dollar of revenue remains after paying off the Cost of Goods Sold (COGS). In other words, it measures the efficiency of a company utilizing its input costs of production, such as raw materials and labor, to produce and sell its products profitably. The gross profit percentage is the gross profit of the business expressed as a percentage of the revenue.

Remember, while gross profit percentage is crucial, it should be considered alongside other financial metrics like net profit margin, return on investment, and cash flow. The most successful businesses take a holistic view of their financial performance, using gross profit percentage as one of several key indicators guiding their strategy. Gross profit percentage is more than just a financial metric—it’s a powerful tool that can drive strategic decision-making and business growth. By mastering the calculation and interpretation of gross profit percentage, you equip yourself with invaluable insights into your business’s operational efficiency and market position. Gross profit, or gross income, equals a company’s revenues minus its cost of goods sold (COGS).

Profit percentage, also known as profit margin or profit ratio, is a measure of profitability that expresses the amount of profit earned relative to revenue as a percentage. Still, you wouldn’t take home the entire $880 in profit at the end of the day. Parts of it will pay for your administrative costs such as rent, marketing, utilities, and salaries of employees not directly involved in making coffee. Gross profit is revenues minus cost of goods sold, which gives a whole number.

Gross profit is the income after production costs have been subtracted from revenue and helps investors determine how much profit a company earns from the production and sale of its products. By comparison, net profit, or net income, is the profit left after all expenses and costs have been removed from revenue. It helps demonstrate a company’s overall profitability, which reflects the effectiveness of a company’s management.

It includes all the costs and expenses that a company incurred, which are subtracted from revenue. It also assesses the financial health of the company by calculating the amount of money left over from product sales after subtracting COGS. COGS, as used in the gross profit calculation, mainly includes variable costs, which are the costs that fluctuate depending on the output of production. Sales revenue provides insights into how much money you are bringing in from your total sales. It is also known as the “top line” because it appears at the top of the income statement.

Cost-cutting measures should also be implemented carefully, as they may impact the quality of the goods or services produced. In this case, the company would need to strategically raise prices while also working on improving its product offering. Gross profit is useful, but a company will often need to dig deeper to truly understand why it could be underperforming. A ratio in itself is not particularly useful unless it is compared with similar ratios obtained from a related source.

If the cost of making a product is too high compared to the price customers are willing to pay, the company may not earn enough. Business owners looking to uncover important information about profitability must become familiar with many figures, including gross profit. This article will help you understand gross profit, how to calculate gross profit massachusetts state tax information and gross profit margins, and why these numbers are critical to more effective business growth and expense management. Gross profit margin is an important metric for measuring the overall financial health of your business. If you have a negative gross profit ratio, it means your basic cost of doing business is greater than your total revenue.

Gross profit (also known as gross income) is the amount of money you make from selling your products and services after you deduct the costs of producing them. The businesses with the highest profit margins are typically service industries like law, banking, and software development. They have low operating costs because they don’t have inventory, which means they subtract less in cost of goods sold and retain more of their revenue.

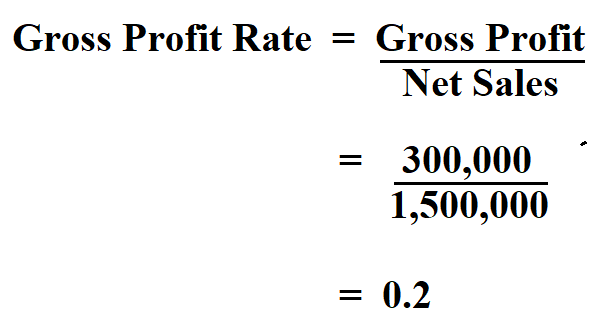

After reviewing his expenses for the year, Garry determined his COGS is $650,000. To forecast a company’s gross profit, the most common approach is to assume the company’s gross margin (GM) percentage based on historical data and industry comparables. The formula for the gross margin is the company’s gross profit divided by the revenue in the matching period.

Revenue is the total value of income generated from sales for a particular period. It is sometimes listed as net sales since it may exclude discounts and deductions from returned or damaged goods. Gross profit, also sometimes referred to as gross income, is revenue minus cost of goods sold (COGS). Now, we will calculate the percentage for gross profitof Apple Inc. for 2016. As per the question, based on the below information, we will calculate the percentage for gross profit for XYZ Ltd. The higher the value, the more effectively management manages cost cutting activities to increase profitability.

Спасибо за письмо

Спасибо за подписку